Hi {{first_name | EduCreator}},

On Monday of this week, I started hosting daily Spaces again on X. These are live social audio events on X, formerly Twitter (very similar to Clubhouse). These events are recorded, so if you’re not able to join us live you can always listen to the replay.

Here’s a recap of yesterday’s Space “Is money the root of all evil.” (thank you Antonio!)

Most of us grew up hearing that “money is the root of all evil.”

But if you’ve ever had to choose between paying rent and buying groceries, you know that not having money can feel pretty evil too.

In our recent live conversation, we pulled this phrase apart from every angle: spiritual, practical, emotional. What emerged was not a simple answer, but a much more useful one: money is rarely the real problem. Our relationship with it is.

Money is not the villain, but our attachment to it might be

Several people immediately went to the original source of the quote. It is not “money is the root of all evil.” It is “the love of money is the root of all evil” (1 Timothy 6:10).

That small difference changes everything.

Money itself is neutral. It can fund a shelter or a scam, a scholarship or a war. The same dollars that pay for addictions can also pay for surgeries, rent, or school fees. As JJ put it, the trouble starts when money becomes an idol when we lust after it, orient our lives around it, or start to justify anything in the name of “getting the bag.”

Others expanded that idea into something even broader: greed. It is not just about cash. People can be greedy for power, attention, status, even affection. Whatever we chase without limits and without perspective can turn us into someone we do not like.

Seen that way, money is more of an amplifier than a villain. Put a lot of it in selfish, fearful hands and you get harm. Put a lot of it in wise, generous hands and you get healing, opportunity, and progress.

The real question becomes less “Is money evil?” and more “Who am I becoming in my pursuit of it?”

When the lack of money does the damage

Auny made a point that hit the room hard: maybe it is not money, but the lack of money that sits at the root of a lot of evil.

When people are desperate, they do things they never imagined they would. They take on predatory debt. They stay in abusive situations. They consider illegal shortcuts. Not always because they are greedy, but because the options in front of them feel impossibly narrow.

We also talked about what happens when big money hits someone who has never been taught how to handle it. James discussed young athletes on massive contracts who implode their careers. Lottery winners who burn through millions in a year and end up worse off than before. It is not the check that destroys them. It is the combination of sudden abundance and zero preparation.

Sonet added a simple but powerful contrast: wealth is not the same as money.

Wealth is health, family, community, wisdom, skills, faith. Money can support those things, but it cannot replace them. Without that deeper wealth, a big bank account often just magnifies the emptiness.

So we end up with two failures:

Poverty that pressures people into bad decisions.

Prosperity without wisdom that lets people weaponize their money against themselves and others.

In both cases, what is missing is not just cash. It is character, support, and guidance around how to relate to money in the first place.

Tithing, generosity, and the spiritual side of wealth

For those of us who come from a faith background, money is not just practical. It is deeply spiritual.

Several verses came up in the conversation:

“Keep your lives free from the love of money and be content with what you have, because God has said, ‘Never will I leave you; never will I forsake you.’” (Hebrews 13:5)

“Remember the Lord your God, for it is he who gives you the ability to produce wealth…” (Deuteronomy 8:18)

That last line is one of my favorites: the ability to produce wealth.

It does not say God rains money down on us. It says He gives us power and capacity to create value and resources.

That is where tithing came in. A few of us shared how tithing shifted our relationship with money:

It breaks the illusion that we are the sole source of our income.

It loosens the grip of fear and scarcity.

It becomes a kind of “cheat code” for generational money trauma because you are constantly practicing trust and release instead of clutching everything in panic.

Is it always easy to give away ten percent of a big check? No. A tithe on ten dollars feels very different from a tithe on ten thousand. But the through-line in the stories was this: each time someone tithed faithfully, provision showed up in surprising ways. Flour for bread. Work opportunities. Unexpected support.

Whether you are religious or not, the principle travels: building wealth without building generosity tends to corrode the soul. You do not have to give through a church, but if you want a healthy relationship with money, some consistent rhythm of giving is almost non-negotiable.

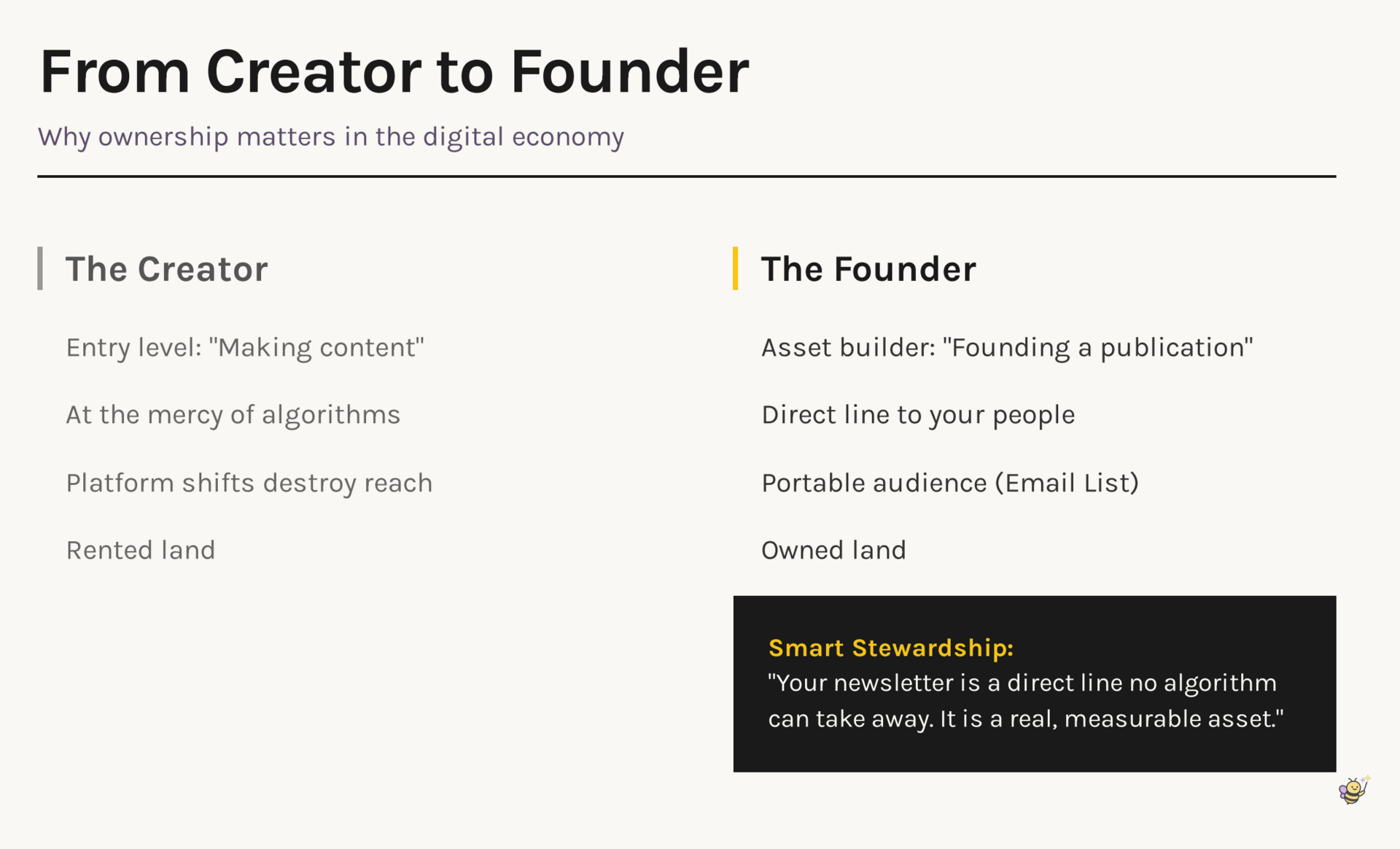

From creator to founder: why owning assets matters

Underneath all this talk about money sat another theme: ownership.

We tossed around the word “creator” and realized it often feels both powerful and oddly small. In practice, “creator” has become the entry level in the online economy. You post. You reply. You show up in live rooms. You are creating constantly.

But if you stop there, you are also at the mercy of algorithms, platform shifts, and other people’s business models.

This is why I am increasingly drawn to the word founder.

When you start a newsletter, you are not just “making content.” You are founding a publication. You are building an asset you own: an email list that no algorithm can take away from you.

In a world where accounts get banned, feeds get noisy, and social platforms pivot every six months, your email list becomes a lifeline. It is:

A direct line to the people who care about your work

A container for your stories, offers, and frameworks

A real, measurable asset that can support a business if you want it to

You do not have to monetize it right away. You might never monetize it at all. But as an adult navigating an uncertain economy, having a way to reach your people outside of any one platform is just smart stewardship.

It is also one way to live out Deuteronomy 8:18 in a very practical way: you are taking the ability to produce wealth and turning it into something tangible.

Practical takeaways

If you feel conflicted about money

Sit down and actually write out what you were taught about money growing up.

Ask: which of these beliefs are mine, and which are inherited fear or shame?

If you are struggling financially

Focus first on stabilizing income in ethical, sustainable ways. Desperation is where bad offers and bad actors thrive.

At the same time, start learning basic money skills: budgeting, saving, and how to avoid predatory debt.

If you have money but feel uneasy about it

Build a regular practice of generosity. That might be tithing, recurring donations, or quietly helping people in your community.

Notice how your internal narrative shifts when you see money leaving your hands and doing good.

If you are building online

Treat “creator” as a starting point, not a destination.

Launch a simple newsletter. One welcome email, one email a week is enough to begin.

Remember: every new subscriber is not just a number. It is part of your long term wealth, in the broadest sense.

If you want to aim for greater wealth

Pursue wisdom at the same pace as you pursue income. Study people who handle money well.

Ask honestly: if I had ten times my current income tomorrow, would my current habits and character be able to carry it?

Why this conversation about money matters now

We live in a strange cultural moment where two harmful stories run side by side.

One says that rich people are automatically suspect, so wanting wealth must make you selfish. The other says that if you are not chasing massive income at all costs, you are lazy or “thinking too small.” Both stories keep good people stuck.

What I heard in this conversation was a third path. We can refuse to romanticize poverty and refuse to idolize money. We can want more resources, not to flex but to serve. To fund work we believe in. To take care of our kids. To have the margin to say no to things that misalign with our values.

We also talked about how much safer and saner it feels to wrestle with these questions inside a real community. Some people in that room have been doxxed. Some walked away from toxic platforms. Some rebuilt reputations after public attacks. What kept coming up was this: stay rooted in integrity, stay close to people who know your character, and keep walking. Everything else eventually comes out in the wash.

Money is not going to get simpler any time soon. The economy will keep shifting. Platforms will keep changing. There will always be someone promising a shortcut.

But if you can ground your money life in wisdom, generosity, and real ownership of your work, you are already far ahead of most of the culture.

Try this this week

Pick one of these and actually do it:

Give a small, intentional gift. It could be a tithe, a donation, or quietly paying for someone’s meal. Notice how you feel before and after.

Open an account on your favorite newsletter platform and draft a welcome email. Even if you do not send it yet, cross the line from “someday” to “this exists.”

Journal on this question for ten minutes: If money were completely off the table, what kind of person would I want to be? Then ask what it would look like to pursue money in service of that version of you, not instead of it.

And if these kinds of conversations help you think more clearly and kindly about money, faith, and building things, stay close. This is the work we are going to keep doing together.

Credits & links

Christel – Host, EduCreator Founder, newsletter founder, and community builder.

Auny – Co-Host, Founder of the “Be Better, Do Better” community and newsletter writer.

Olabode – Co-Host, writer, and newsletter founder.

JJ – Early retiree and investor sharing hard won lessons about wealth.

Skittles – Community member and sharp, unfiltered voice in the conversation.

Clark – Commentator on power, greed, and corporate behavior.

UnKonfined – Artist and entrepreneur reflecting on money as a tool and true wealth.

Sonet – Navy veteran, mother of seven, and sourdough baker who lives generosity.

HoneyBadger – Long time creator and powerful example of resilience and integrity online.

Megs – Productivity coach, writer, and newsletter founder focused on intentional living.

UltraKing – Community member, soundboard master, and advocate for wisdom before wealth.

James – Sports fan highlighting cautionary tales of sudden money without guidance.

Join Us Today at 2pmEST

Today’s topic is “What would you title your memoir?”

Join here.

That’s all for now,

Christel

Want to support my work? You can buy me a flower here 🌸

Ready to start your newsletter? Click here to sign up for a free trial and reply to any of my emails to let me know so I can help you set up.